Table Of Contents

What Is Payout Ratio Formula?

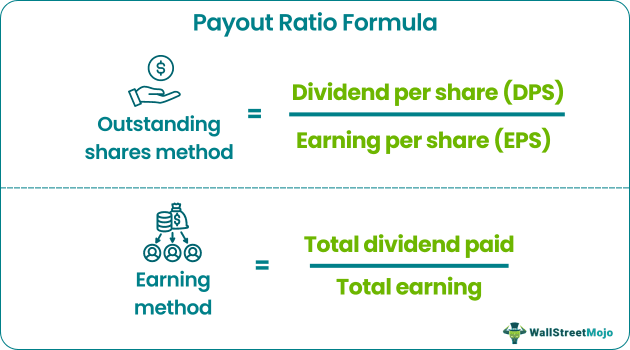

The payout Ratio formula calculates the amount announced as a dividend to the shareholders out of the company's total earnings (after-tax profits). There are three ways to calculate the dividend payout ratio formula depending upon the availability of particular data.

The dividend payout ratio formula demonstrates the company's intention to partake in the earnings of a particular period. After observing factors such as upcoming projects or uses of funds (if withheld ) in the business for expansion policies or to boost the company's reserves, the management decides whether to announce a dividend.

Key Takeaways

- The payout ratio is the total denomination of the dividends given out to shareholders against its revenue. It can be calculated using the Outstanding Shares Method, Earnings Method, and retention ratio.

- The outcome of the ratio can lead to different conclusions. For instance, a high payout ratio indicates the company's wealth using profit or uncertain investment plans.

- One of the most important concepts to consider while interpreting the payout ratio outcome is the company's intention and purpose to give out dividends.

- Payout ratios are highly shaky, meaning they can change year-to-year, quarter-to-quarter, etc., depending on the company's financial performance.

Payout Ratio Formula Explained

The optimum payout ratio formula helps calculate the dividend percentage that a company pays to its shareholders from the profits earned. Some key terms used in the calculation are explained below.

- Dividend = It is a reward from the company’s earnings to the shareholders of the company. The dividend mostly paid in cash could also be paid in kinds, such as a share of stock or part or property rights. Though shareholders approve the dividend, the company’s management decides in the first place to announce it. It is not mandatory to announce it and depends upon the decision of the management of the company. Apart from companies, various mutual funds exchange-traded funds also pay dividends. From there too it is possible to understand the above details give a clear idea about what is dividend payout ratio formula.

- Dividend Per Share (DPS) = The total dividend amount divided by outstanding shares of the company is known as dividend per share.

- Earnings = the profit ( after-tax profits) earned by the company over a particular period (generally quart https://www.wallstreetmojo.com/earnings-per-share-eps/-annually, yearly).

- Earnings Per Share (EPS) = the profit ( after-tax profits) earned by the company over a particular period (generally quart https://www.wallstreetmojo.com/earnings-per-share-eps/-annually, yearly).

- Retention Ratio = is the percentage of profit a company decides to keep in the business (after paying off the dividends) to use it for expansion or other purposes. It is the opposite of the dividend payout ratio and the remaining portion of the dividend payout ratio (1- dividend payout ratio). The profits left after the dividend payment are transferred to the Retained Earnings.

The above details give a clear idea about what is dividend payout ratio formula.

How To Calculate?

Let us look at the optimum payout ratio formula for calculating the ratio.

Dividend Payout Ratio (using Earning Method)= Total Dividend Paid / Total Earning

Dividend Payout Ratio (using Outstanding Method) = Dividend Per Share (DPS) / Earning Per Share

Dividend Payout Ratio = ( 1 - Retention Ratio )

Thus, given above is the target payout ratio formula.

Examples

Now let us understand the payout ratio formula example.

Example #1

As per recent data, XYZ Inc. has reported a dividend per share (DPS) of $5 per share and an earning per share (EPS) of $20 per share. First, calculate the Dividend Payout Ratio.

Solution

Using the below-given data for calculation of the payout ratio, the calculation of the dividend payout ratio is as follows,

- =$5/$20

Thus as per the target payout ratio formula the dividend payout will be –

- = 25%

It indicates that out of $20 of earning per share, the management has decided to pay shareholders 25% of the earnings. Thus the dividend payout ratio turns out to be 25%.

Example #2

Here is another payout ratio formula example.

Market experts have observed that the US banks’dividend payout ratio is much less than what it was in before Covid. Even though a total of $54.32 billion has been given out as dividends to the shareholders, still the amount is not enough to beat the payout in 2020.

Relevance And Uses

As we can see, the dividend payout ratio is quite high, i.e., 36%, indicating that the company either has earned very good profits or doesn't expect any investment plans in the future. Thus paying a dividend at a higher rate.

The ratio on its own does not specify any relevant information. It stands for the company's intention and practices of announcing a dividend over time. There is no guarantee that the payout percentage paid in the current year will be followed in the future too. To get a clear picture of the intention and visibility of dividends, we need to see this ratio in some context. Some of those insights are mentioned below:

- Suppose we are testing a growth-oriented company with substantial opportunities or expansion plans ahead. In that case, it's usual that management would take a big pie of the earnings in the company as that would help the companies to choose the expansion drive. If the administration oversees the expansion plan, it seems plausible to restrict dividend payout.

- If the company is mature and stands at the level where it doesn't foresee opportunities for the fund's requirements, it could pay off the dividends to the shareholders. It also happens when the earning at which a company could earn turns out to be lower than the market rate; then, it is better to transfer the extra or unused funds to the shareholders.

- Sometimes, when a company engaged in consistent dividend payments turns out to be hoarding dividends for some time, the company could face serious repercussions if they do not have a strong reason to back their move. Withdrawal of dividends directly impacts share price, and most of the time, to maintain the level of a stock price, the company keeps paying a dividend even from its past reserves.